When Pf Withdrawal Is Taxable

You can make this withdrawal in case you have switched your job and do not want to get yo. Form 990-PF is also filed by these taxable foundations.

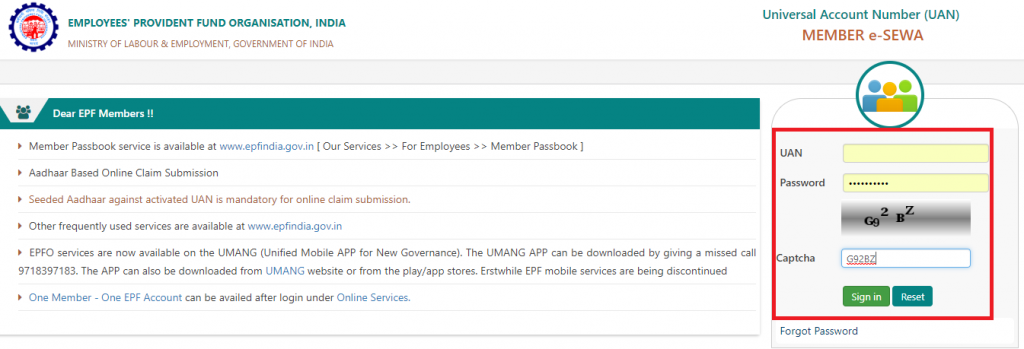

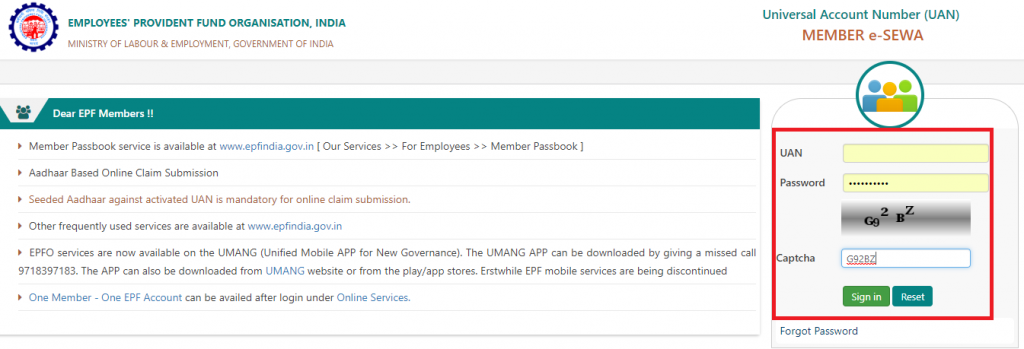

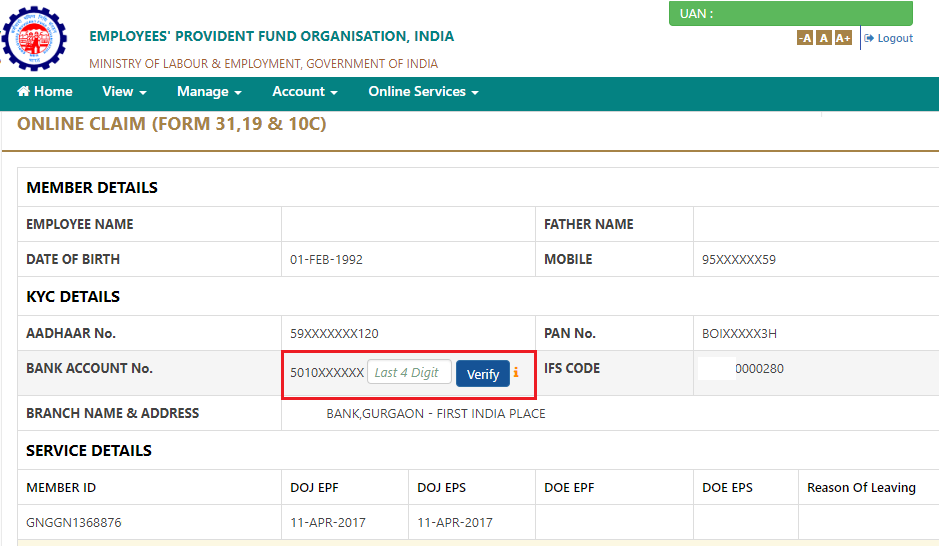

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

PF can be withdrawn 2 or 3 times on non-refundable basis.

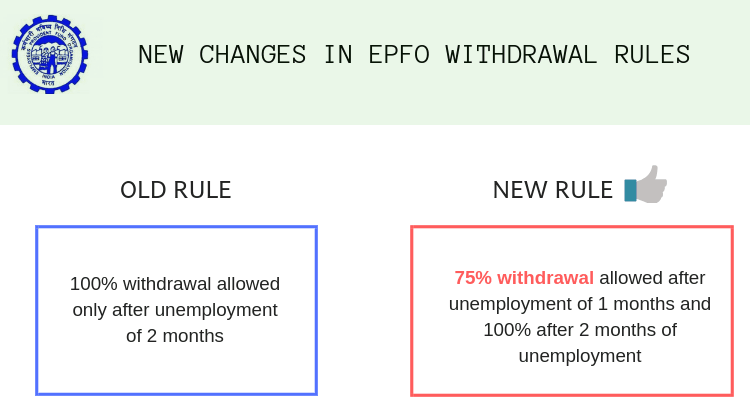

When pf withdrawal is taxable. If a person is unemployed he can withdraw 75 of the PF deposit after one month of unemployment and remaining 25 after two months. I am yet to receive sms and funds under 10C but in the portal 10C shows claim settled. PF money can be fully withdrawn only after retirement and not when working except under some conditions.

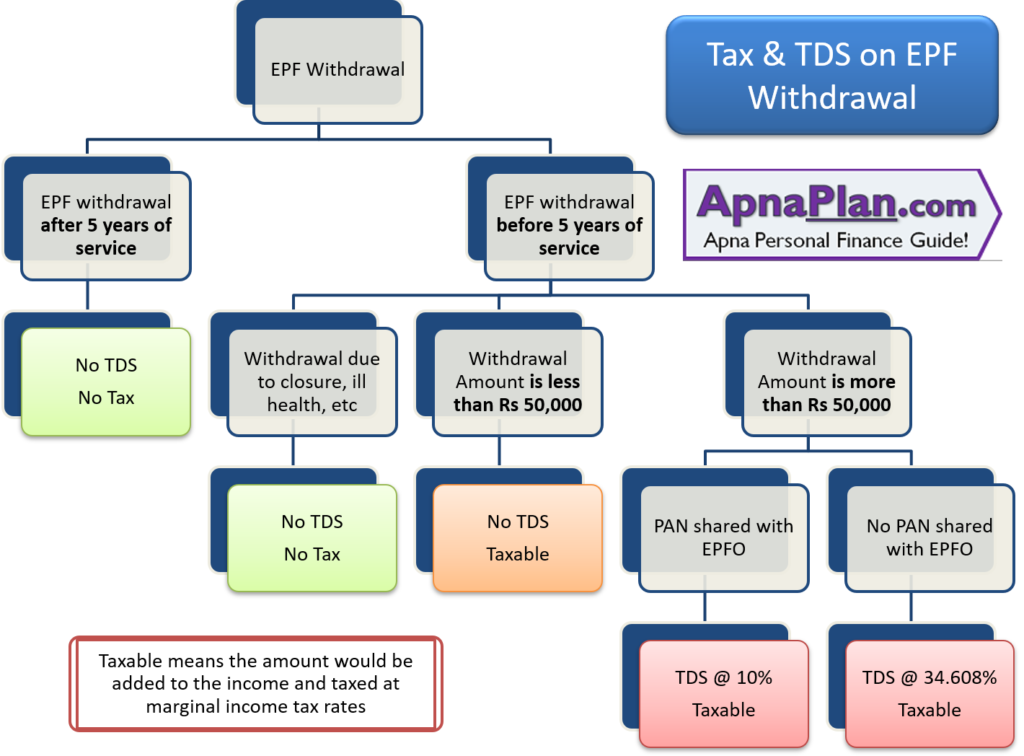

Salary certificate contains necessary information related to an employees salary break-up including the tenure of employment. Non-resident taxable persons Persons paying TDS under section 51 of CGST Act. If the money is withdrawn from the EPF account at the time of maturity or partial withdrawal is made as allowed under the EPF scheme such as for the purpose of marriage building a house etc then the withdrawal is exempted from tax.

It is issued to employee by employer to declare employment. Earlier if you had paid premiums less than 10 of the total insurance cover than the maturity amount would not be taxable. The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemic.

Income Tax Return for Certain Political Organizations. Section 501c organizations must file Form 1120-POL if they are treated as having political organization taxable income under section 527f1. But if you are making a partial withdrawal or complete withdrawal before maturity then EPF withdrawal is taxable.

Ways to Withdraw PF Amount Although withdrawal of PF isnt allowed while you are still employed there are ways to get this amount in case you need it badly. This is because COVID-19 has been declared a pandemic by. If their total income is not taxable the employee should submit the Form 15H15G as a declaration.

If the PF fund is transferred to NPS he she wont be liable to pay tax on withdrawal The liable tax depends on the employees salary in the withdrawal year. When withdrawal from EPF account is taxable. I have received funds in my account on 12th Nov under form19.

Now contribution above Rs25 lakh will be taxable during the time of withdrawal of the PF amount. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. EPF withdrawal is taxable and exempted under certain situations.

The new PF advance or PF withdrawal rule will apply to all establishments across the country. GSTR-9 filing for businesses with turnover up to Rs 2 crore made optional for FY 17-18 FY 18-19 and FY 2019-20. However members can apply for lesser amounts as well.

I had applied online for withdrawal of my PF and pension under the respective forms ie form19 and form 10C on 23rd Oct 20. Although the PF amount is exempted from tax till the time of maturity. Provident Fund Withdrawal.

75 Of Epf Can Be Withdrawn Just After A Month Of Unemployment

Epf Withdrawals New Rules Provisions Related To Tds

Withdrawing Your Epf Know The Tax And Tds Details

Tax On Epf After Resign Retire Or Terminated Basunivesh

Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules

Your Pf Balance Remains Tax Free In These 2 Conditions Even If You Have Left Job Within 5 Years The Financial Express

Pf Withdrawal Form Know Epf Withdrawal Procedure

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Form Claming Pf Amount Legalraasta

Pf Withdrawal After 5 Years Of Continuous Service Is Tax Free Know How It Is Calculated

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Form Claming Pf Amount Legalraasta

Posting Komentar untuk "When Pf Withdrawal Is Taxable"